is property tax included in monthly mortgage

Property taxes are included as part of your monthly mortgage payment. Although it may not be a top priority you may wonder if your property taxes are included in your monthly mortgage payments.

Pennsylvania Property Tax H R Block

Property taxes are included as part of your monthly mortgage payment.

. The Federal Housing Administration requires all new borrowers to pay taxes as part of the monthly payment. Are Property Taxes Included In Mortgage Payments. Property tax is included in most mortgage payments.

While private lenders who offer conventional loans are usually not required to. In fact lenders often require monthly property. For most types of loans taxes are included in your mortgage payment.

Property tax is included in most mortgage payments. Paying property taxes is inevitable for homeowners. The most likely answer is yes but you should.

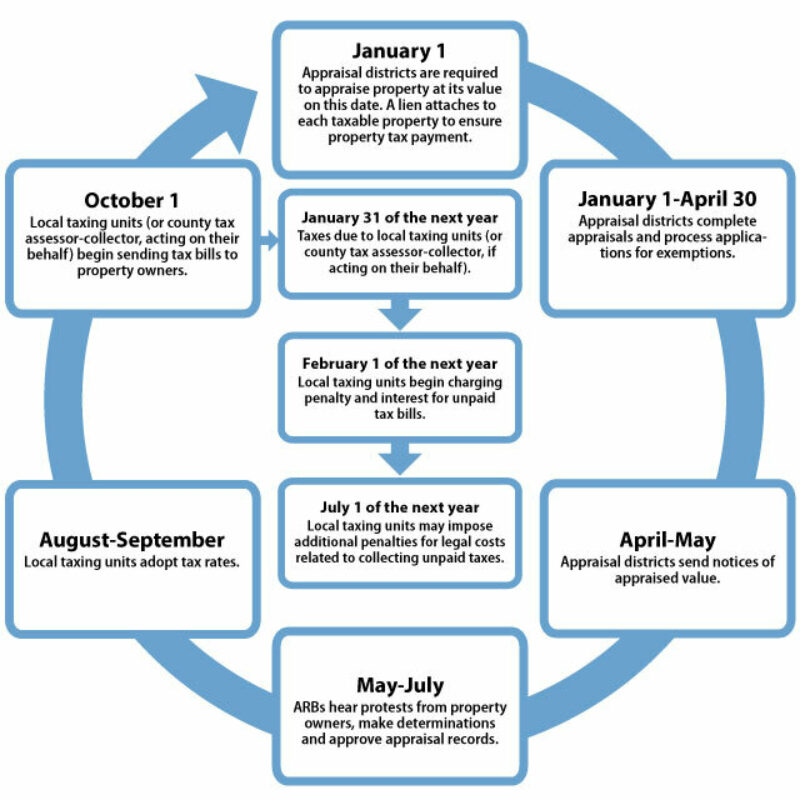

At closing the buyer and seller pay for any outstanding. Tip FHA requires borrowers to pay property taxes monthly. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly.

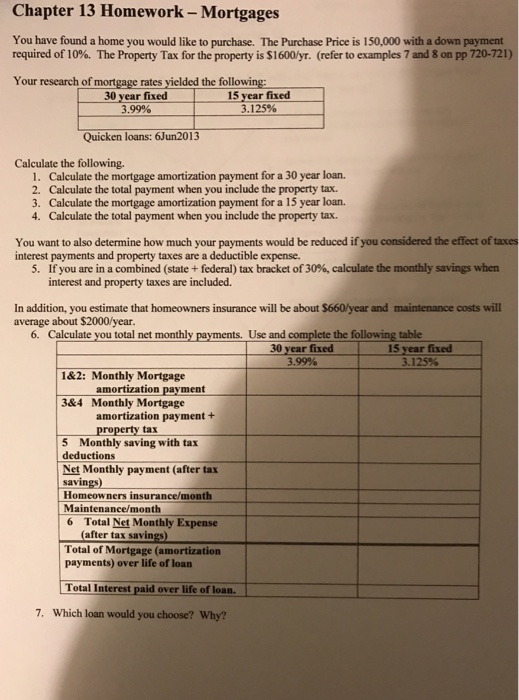

Are Property Taxes Included In Mortgage Payments. Your mortgage payment is. For example say the bank estimates your 2022 property tax to be 1200 which works out to 100 per month.

According to SFGATE most homeowners pay their property taxes through their monthly payments to their mortgage lenders. Your property taxes are included in your monthly home loan payments. Learn about mortgages property taxes if you need to talk to your lender about these.

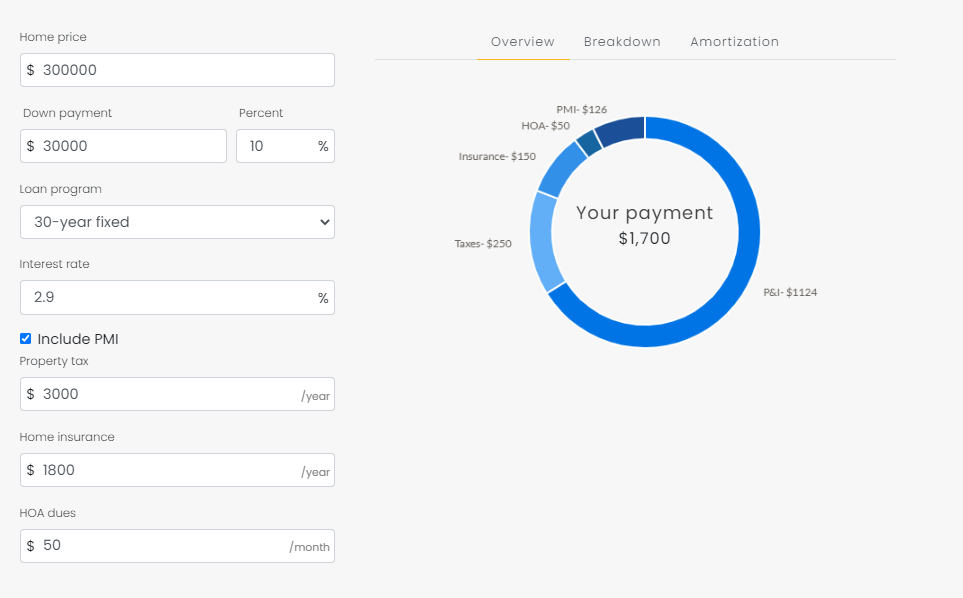

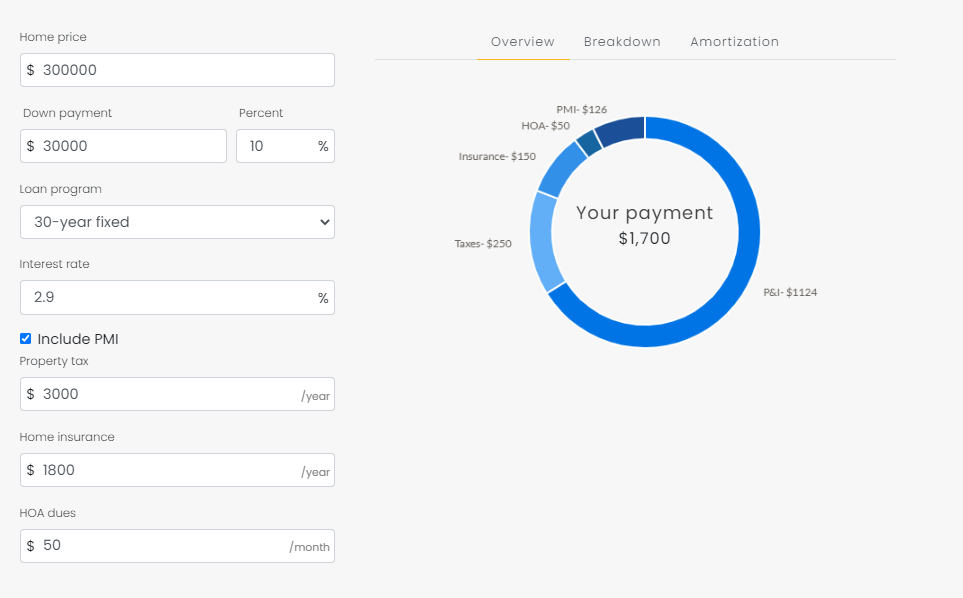

Your monthly mortgage payments include the principal interest property tax mortgage insurance and homeowners insurance. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. Your monthly payment includes your mortgage payment consisting of principal and interest as well as property taxes and homeowners insurance.

The bank would add the 100 to your monthly mortgage bill. Usually the lender determines how much. The amount each homeowner pays per year varies depending on.

So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. You can check your monthly mortgage statement or closing documents if youre a new homeowner. Property taxes are usually included in monthly mortgage payments.

With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a. The answer to that usually is yes. If you get a home.

Frequently Asked Questions Treasurer

Coming Home To Tax Benefits Windermere Real Estate

Mortgage 101 What S In Your Mortgage Payment

All About Property Taxes When Why And How Texans Pay

How To Use A Mortgage Calculator Fbc Mortgage Llc

Mortgage Calculator Estimate Your Monthly Payments

:max_bytes(150000):strip_icc()/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

Buying A House With Cash Vs Getting A Mortgage

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Mortgage Calculator How Much Monthly Payments Will Cost

Alabama Property Tax H R Block

Home Mortgage Calculator Pmi Interest Taxes And Insurance

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

Solved Chapter 13 Homework Mortgages You Have Found A Home Chegg Com

Best To Pay Property Taxes Directly Or With Monthly Mortgage Payments