michigan gas tax increase history

Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. For fuel purchased January 1 2017 and through December 31 2021.

Usa Time Zones Time Zone Map Time Zones Map

Michigans diesel fuel tax was adopted in 1947 at a rate of five cents per gallon.

. Throw in the 184. 30 0003 General Fund 00 0000 What Makes Up the Price of a Gallon of Gas Assuming gasoline costs 200 per gallon Figure 2 of a gallon of gasoline is 200 per gallon the Michigan sales tax comprises 102 cents of that price. Michigan fuel purchases are also subject to the 6 state sales tax.

Two years later in 1927 the rate was increased to three cents per gallon. Fuel producers and vendors in Michigan have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Michigan government. 36 states have raised or reformed gas taxes since 2010.

See the current motor fuel tax rates for your state as of April 2022. This week Gov. The cost of vehicle registration isnt the only travel related price increase coming in 2017.

Heres what MDOT says on the issue. Gasoline 272 per gallon. Find Information Compare Results on find-infoco.

Michigan fuel purchases are also subject to the 6 state sales tax. Then another constitutional amendment increased that to 6 in 1994 through another vote. LPG tax is due on the 20th of April July October and January Quarterly tax except for motor fuel suppliers 20th of each month.

The gasoline tax of 19 cents a gallon will. Compare Answers Top Search Results Trending Suggestions. It will also hike the states Earned Income Tax Credit.

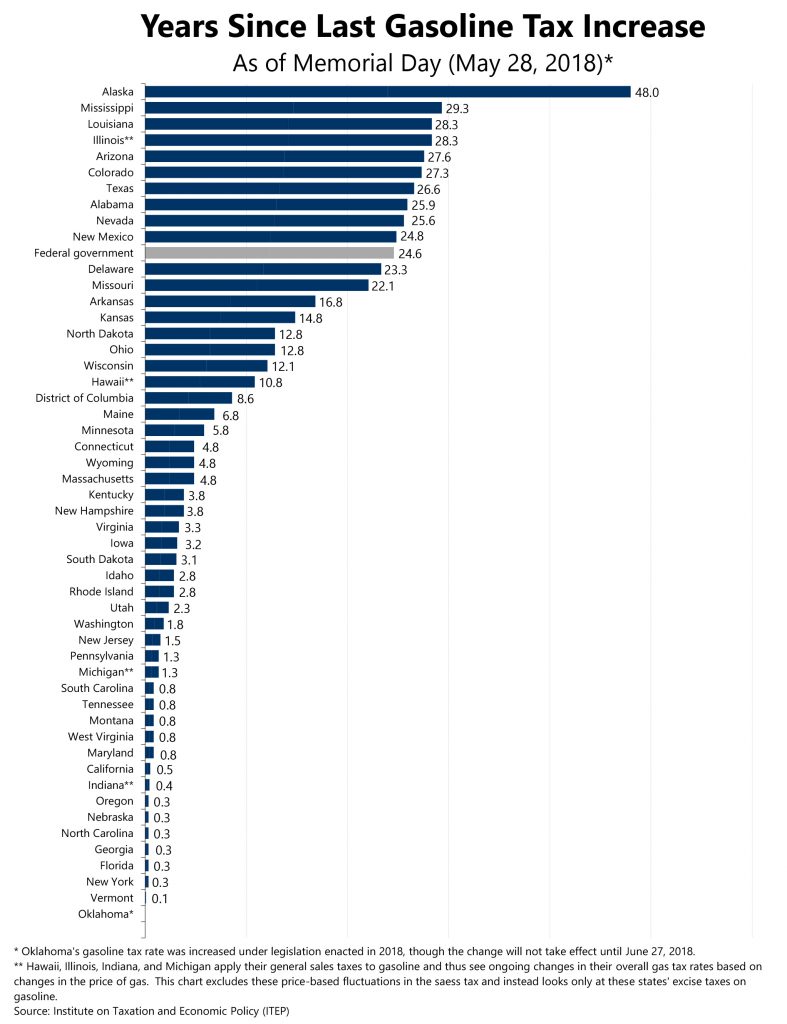

Whitmer proposed a 45-cent gas tax increase to help fix Michigans crumbling roads. Thirteen states have gone two decades or more without a gas tax increase. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon.

When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. Whitmers proposed three-step increase over a one-year period would give Michigan the highest fuel taxes in.

Alternative Fuel which includes LPG 263 per gallon. Based on retail price of 2746 per gallon Michigan average for regular gasoline during 2018. The Michigan gas tax will also rise 73 cents per gallon.

For fuel purchased January 1 2022 and after. Nineteen states have waited a decade or more since last increasing their gas tax rates. Each time you purchase gasoline in Michigan youre paying.

At that rate Michigan motorists would pay 76 million more in the state gas tax each year starting in 2022. Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. Gasoline 263 per gallon.

Sharing 240 0025 Comp. Diesel Fuel 263 per gallon. It is the states first fuel tax hike in 20 years and the first major vehicle fee increase since 1983.

On top of excise taxes many states also apply fees and other taxes including environmental fees inspection fees load fees clean-up fees along with LUST taxes license taxes and petroleum taxes. Ad Search Smarter with find-infoco. Based on retail price of 2746 per gallon Michigan average for.

Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to the states School Aid Fund. Diesel Fuel 272 per gallon.

On May 5 Michigan residents will vote on a constitutional amendment and a package of bills that will go into effect if approved. Proposal 1 would increase the sales tax from 6 to 7 percent raise the fuel tax and increase vehicle registration taxes among other things. Another 74 or 167.

1 Among the findings of this analysis. This may well bring the annual increase close to the 5 maximum if not higher. Michigan Fuel Tax Reports.

Find Info on find-infoco. In 1960 voters approved an increase of the 3 sales tax to 4 effective January 1 1961. Motorists here already pay the 184 cent per gallon federal gas tax.

The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased. Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a current gas tax increase proposal is implemented.

Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

.png)

Map State Gasoline Tax Rates Tax Foundation

Us Housing Inventory Requiring Deleveraging Estimated At 30 Million The Unit House Inventory

How Long Has It Been Since Your State Raised Its Gas Tax Itep

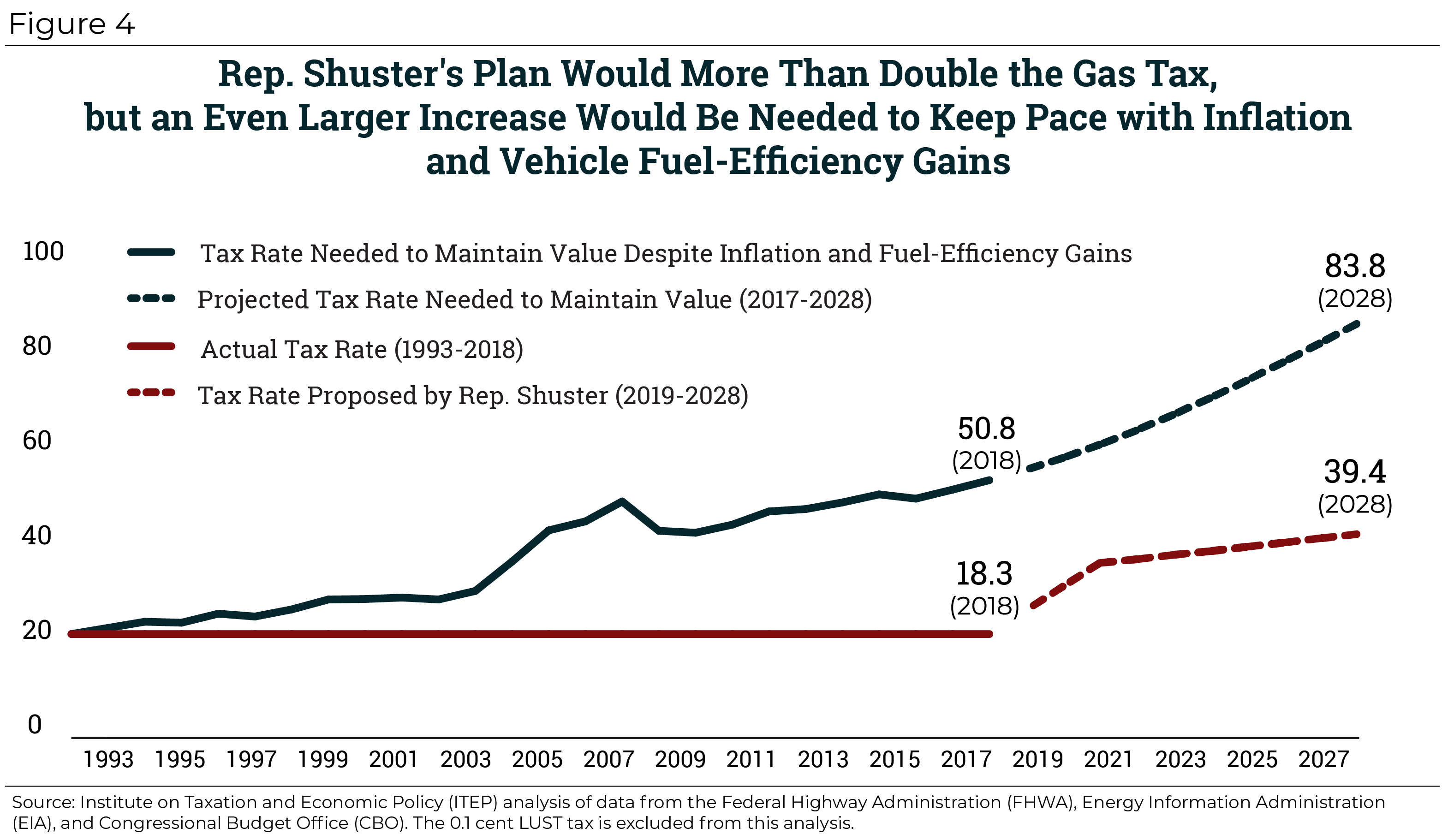

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Michigan S Gas Tax How Much Is On A Gallon Of Gas

U S States With Highest Gas Tax 2022 Statista

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Motor Fuel Taxes Urban Institute

Most States Have Raised Gas Taxes In Recent Years Itep

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

1966 Chevrolet Impala S134 Indy 2020 Impala Chevrolet Impala Chevrolet

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Vintage Wisconsin Senate News Summer 1975 Single Sheet W Info On Both Sides